Seize the Momentum: New Liquidity Program for One-Month CORRA Futures (COA) now live

We're thrilled to announce the launch of a new Liquidity Program for One-Month CORRA Futures, bringing significant improvements to your trading experience! You can now benefit from:

- A continuously quoted market across four contract months.

- Enhanced market transparency thanks to the addition of new market makers.

- More than 300 contracts in size and less than 1 bp wide spread.

- Ability to trade calendar spreads and 1M COA vs 3M CRA spreads.

Market Making Program on Options on Three-Month CORRA Futures (OCR)

The Bourse has implemented a market-making program for Options on Three-Month CORRA Futures (OCR), fostering on-screen liquidity. The program, in partnership with TD Securities and BMO Capital Markets, allows participants to better customize their CORRA exposure and manage non-linear risk.

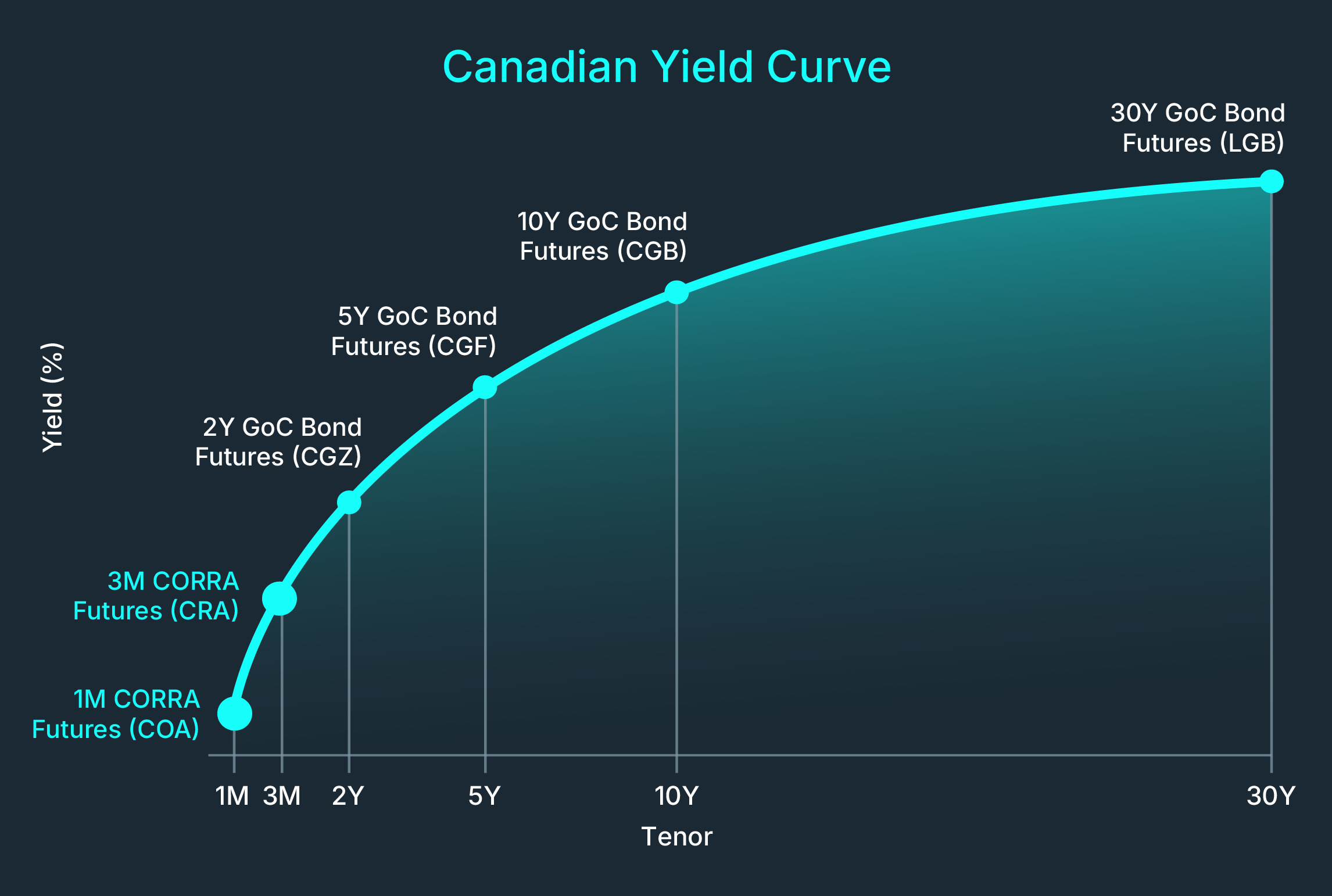

1M, 3M and Options on 3M CORRA Futures Contract Specifications and Overview

1M and 3M CORRA Futures Product Specifications

Montréal Exchange offers 1M and 3M CORRA Futures. View contract specifications.

1M and 3M CORRA Futures Overview

Find out more about our 1M and 3M CORRA Futures, as well as product benefits and opportunities!

Options on 3M CORRA Futures Contract Specifications

Montréal Exchange offers Options on 3M CORRA Futures. View contract specifications.

Trading Strategies

Options on the Three-Month CORRA Futures

1M CORRA Futures

Final Settlement Price

The final settlement price is based on the realized CORRA value during:

-

The contract month (1M CORRA Futures)

For calculation examples Click here -

The reference quarter (3M CORRA Futures)

For calculation examples Click here

Illustration of final settlement price calculation for 3M CORRA Futures

What is CORRA?

CORRA measures the average cost of overnight general Government of Canada collateral repo transactions and is a representative measure of overnight funding rates.

As part of its efforts to increase the robustness and representativeness of the benchmark rate, the Bank of Canada has implemented enhancements to the CORRA calculation methodology. The enhancements to CORRA result in a rate that is less volatile and closer to the Bank of Canada’s target for the overnight rate, on average.

The complete methodology as well as an illustrative historical time series are available on the Bank of Canada website.

MX offers one-month (1M) and three-month (3M) CORRA Futures to facilitate the overall transition from IBORs (InterBank Offered Rates) to RFRs (Risk-Free Rates) in Canada.

The products were launched in conjunction with the Bank of Canada taking over the administration of CORRA, and are designed to support and foster the growing role this rate will play in the market for Canadian financial products.