History of the Montréal Exchange

Creating Strong Foundations

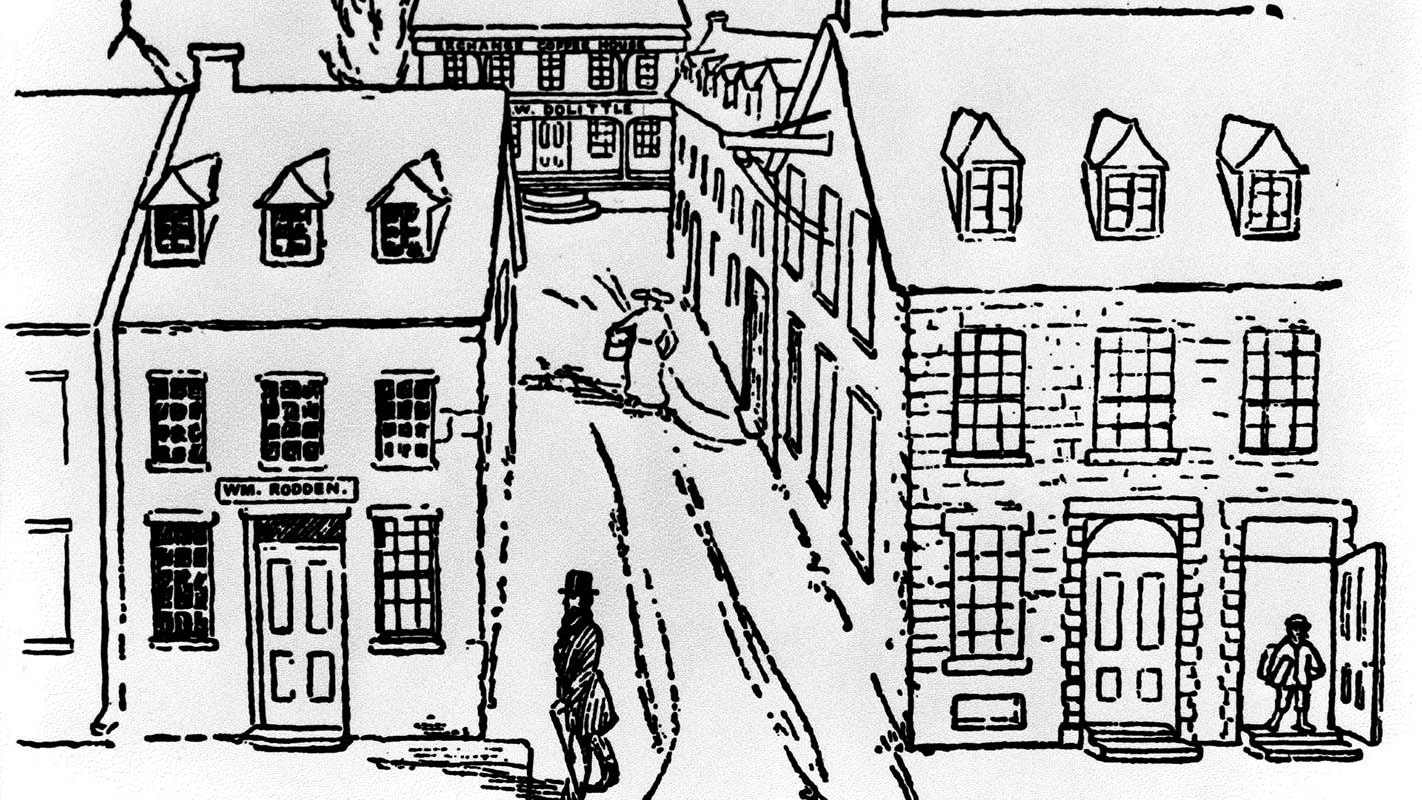

On May 1, 1832, several of Montréal’s leading merchants, including brewer John Molson and Peter McGill, President of the Bank of Montreal, met at Asa Goodenough’s Exchange Coffee House at the corner of rue Saint-Paul and rue Saint-Pierre in Old Montréal.

They gathered to raise money for Canada’s first railway, the Champlain and St. Lawrence Railroad. They all contributed money, and invited members of the public to buy shares.

The mid-19th century was a period of enormous growth in Montreal generally, and in trading more specifically. The Board of Stock and Produce Brokers was established in 1842 to promote and standardize the sale of stock and produce, and in 1848 a group of local merchants set up the Board of Brokers.

The move to formalize trading grew steadily in response to urgent needs for capital in Montreal, Quebec and, as of 1867, the Dominion of Canada.

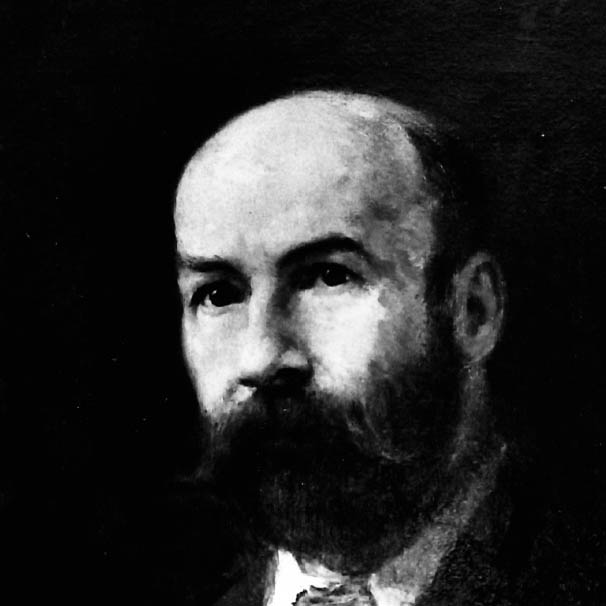

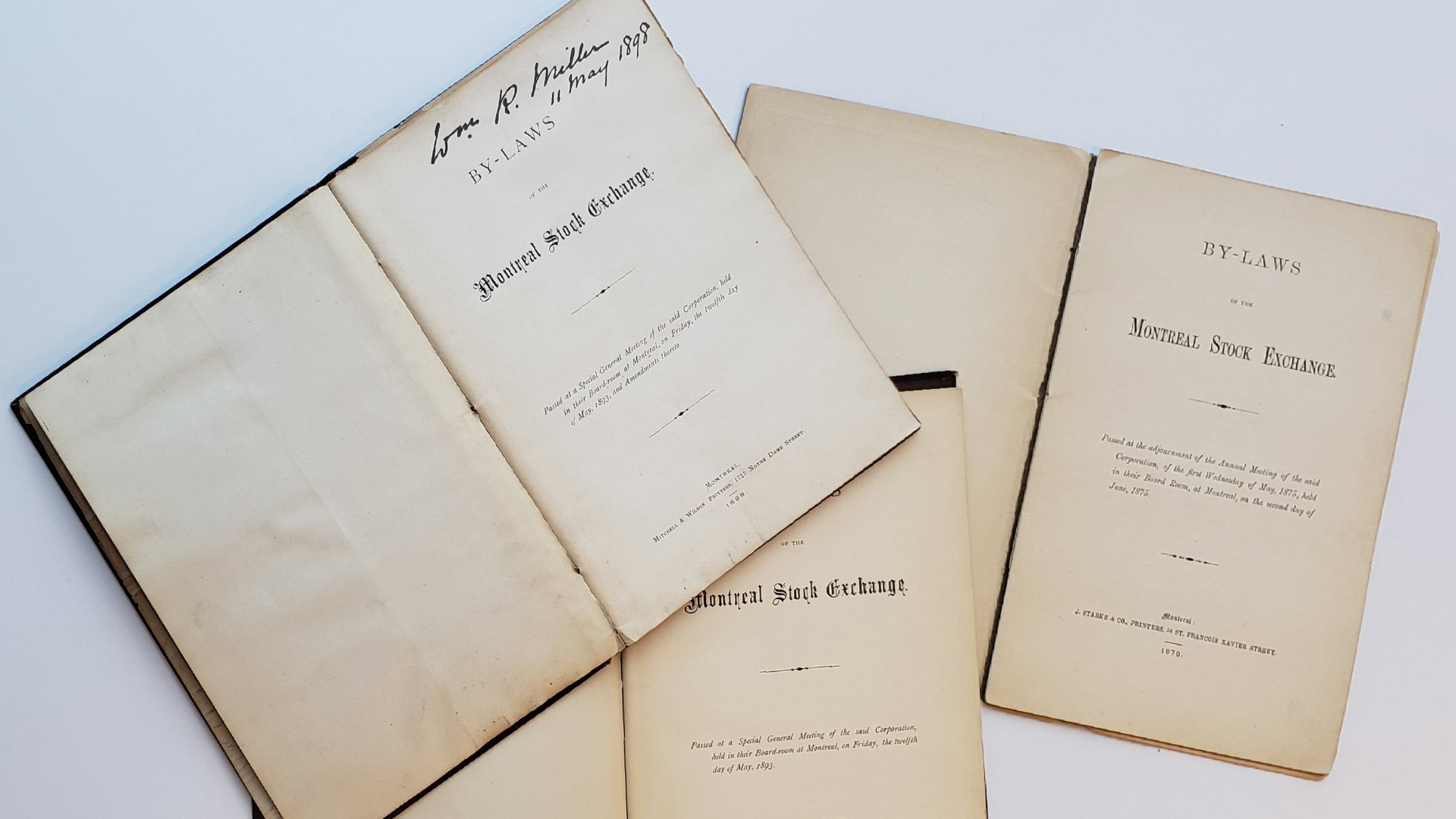

Leadership and inspiration took things to the next level. Under the guidance of several brokers, including three MacDougall brothers – Dugald Lorn, Hartland St. Clair and George Campbell – the Board of Brokers morphed into the Montreal Stock Exchange in 1872. Two years later, on January 28, 1874, the Montreal Stock Exchange was formally incorporated under a special charter by an act of the Legislature of Quebec.

According to that charter, the newly established corporation was “to provide and regulate a stock exchange and offices in the City of Montreal”. The Exchange would also “compile records and publish statistics respecting the business of the members of the said stock exchange”.

We had only 63 shares listed in our first year, daily trading was often fewer than 800 shares, and we had 40 members. But we were growing on a strong foundation. By 1900, average daily trading was approximately 7,000 shares among our 45 members.

Towers of Ambition

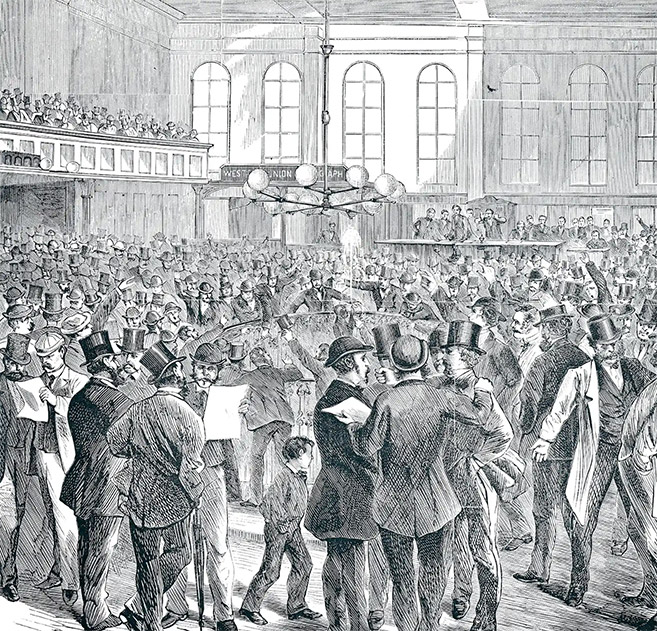

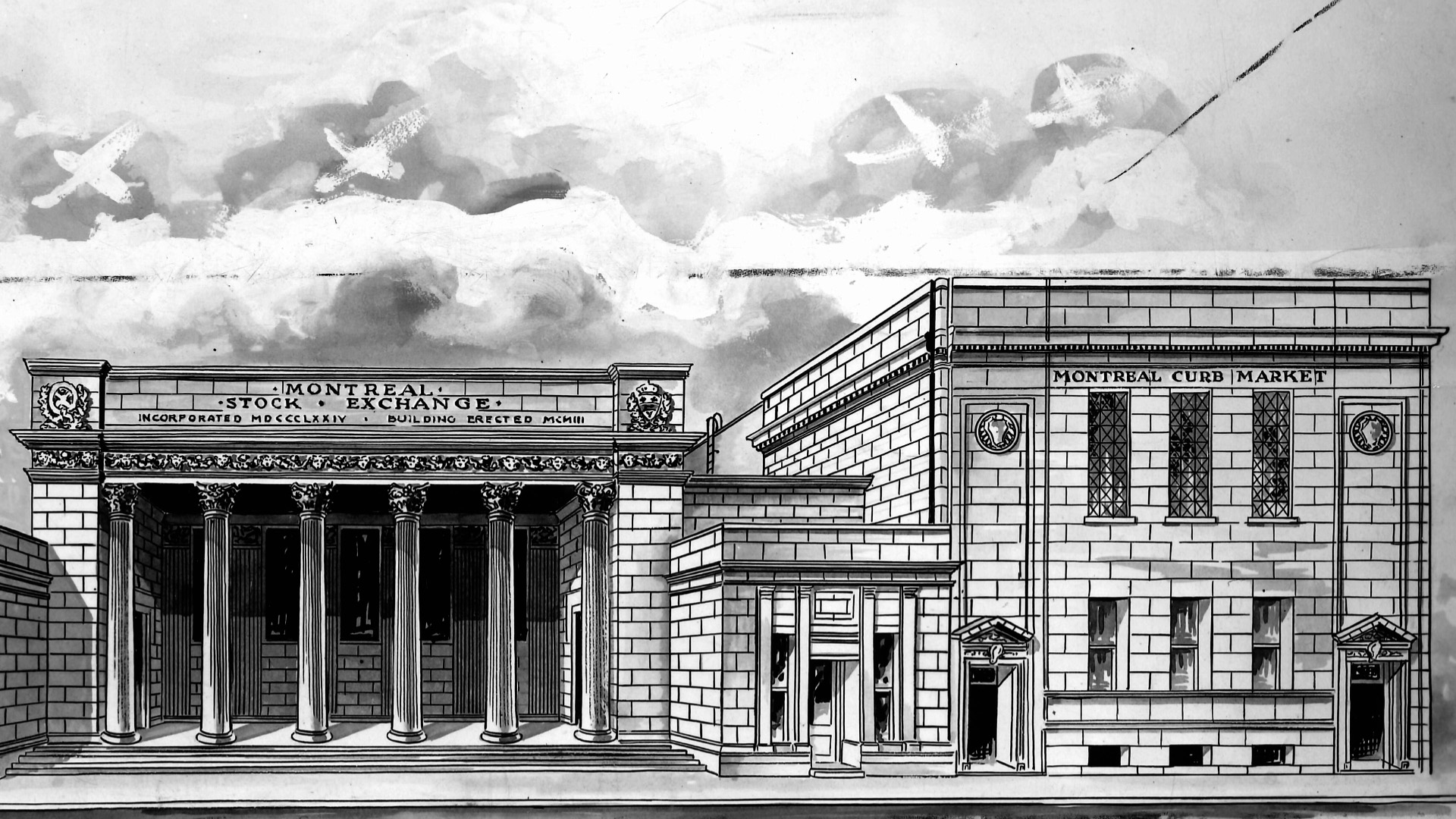

Trading on the newly chartered Montreal Stock Exchange was in a small room on rue Saint-François-Xavier. We moved to the Merchants’ Exchange Building a decade later, with trading happening on the second floor in a room that was approximately 2,000 square feet.

Trading was bustling, and by early 1900 we needed more space. The Exchange moved in 1904 into a large new building at 453, rue Saint-François-Xavier that reflected our vital role in financing the ambitions of a new century.

From 1900 to 1915, a total of 34 skyscrapers were built in Montreal’s expanding downtown, and many of these buildings were for firms listed on our Exchange. This impressive vertical and horizontal growth reflected the city’s metropolitan status.

Our new Exchange building was designed by George B. Post, who also designed the New York Stock Exchange building that had opened only one year earlier. Calls of “buy” and “sell” rang out on our floor for more than 60 years.

We moved in 1965 to an innovative, 48-storey tower in Victoria Square. On October 21, 1965, Mayor Jean Drapeau, Quebec Premier Jean Lesage and other VIPs opened a new chapter in our storied history, as captured by the opening-day’s celebration theme: “The oldest exchange in Canada becomes the most modern in the world.”

In 2018, we moved once more, this time to the newly built Deloitte Tower nestled between two Montréal landmarks: Windsor Station and the Bell Centre®.

Capitalizing Montréal

The dawn of the 20th century was a period of massive growth. Montréal-based manufacturing soared from $85 million in 1900 to close to $200 million only ten years later. That same figure was more than $550 million by 1928.

Montréal was Canada’s financial capital at the time, stimulating much of that growth. Our stock list expanded and trading volumes rose. By 1907, we were among the world’s major exchanges, attracting domestic and international investors.

Trading on Toronto Stock Exchange surpassed ours in the early 1930s. But we continued to expand and innovate in serving the needs of Montréal-based firms such as Bell Canada, Power Corporation and Rio Tinto (Alcan), among others, contributing to local, national and, in some cases, global growth.

Like many of our Montréal-based clients over the years, we have actively capitalized on opportunities to link Montréal to the world. Making strategic connections to international exchanges forges those links.

Financing a Growing Country

A brewer and a banker, among others, started trading in Montréal in 1832 to finance a railway.

As these and many subsequent examples highlight, the Montreal Stock Exchange has helped stimulate the industrial, financial and physical expansion of Canada within North America and abroad for more than 150 years.

On December 30, 1954, James Weir, the Exchange’s Chairman, captured the essence of this stimulus in his year-end speech. It was our 80th year, and trading had broken all-time records, as had the prices of many stocks. In comments that looked back and ahead, James said the Exchange’s strong performance was “a reflection of the people’s confidence in the growth prospects of our country.”

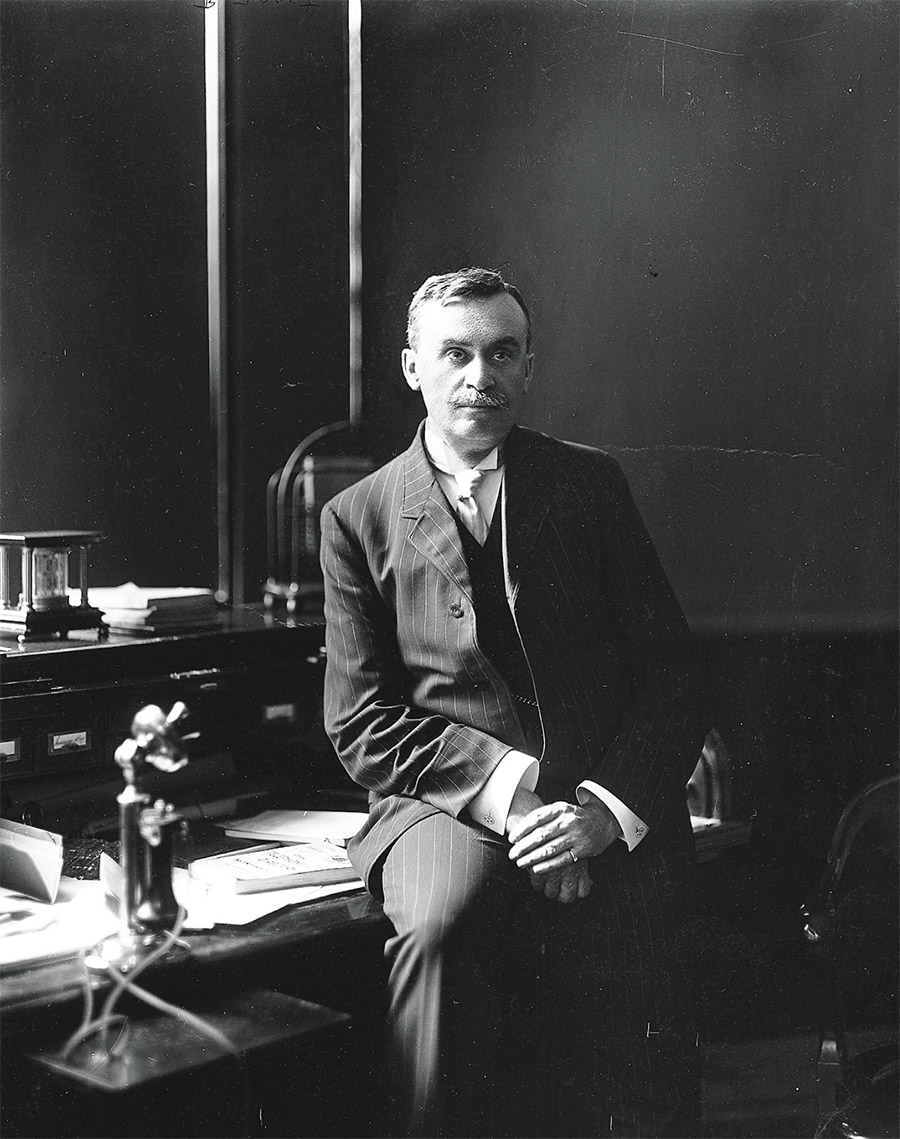

Two years later, on October 16, 1956, Exchange President Henry Norman launched a national education program dedicated to teaching Canadians about the value of share ownership and the benefits of participating in the capital markets. Henry’s speech marked the start of his tenure as our first full-time President.

Montreal Stock Exchange has always been a crucible of growth in which innovative ideas meet risk capital. It’s an alchemy that drives higher productivity and creates wealth across sectors and across Canada.

Operating Dynamic and Reliable Marketplaces

Through growth, acquisitions and strategic integrations, we have regularly innovated to offer dynamic, reliable and advanced trading facilities for 150 years.

Fostering growth at various stages of an issuer’s evolution has been part of that story. Between 1926 and 1933, for example, 25 issuers moved from the Montreal Curb Exchange – established in 1926 as a marketplace for emerging stocks – to the Montreal Stock Exchange.

We announced game-changing innovation on June 4, 1964 by boldly declaring that we would become “the most advanced electronic stock exchange system in the world.” A decade later, in our centennial year, the Montreal Stock Exchange merged with the Canadian Stock Exchange – the renamed Montreal Curb Market – and the organization retained the name of the larger exchange.

In 1975, we began our transformation into a financial derivatives exchange by becoming the first exchange in Canada to offer stock options.

The pace of change kept increasing, leading the way to founding Canada’s first derivatives clearinghouse, the Montreal Options Clearing Corporation in 1975. Changing our name in 1982 to Montréal Exchange reflected the growing importance of options and futures on our trading floor.

The pace of change increased rapidly over the following years. The launch in 1983 of Montréal Exchange Registered Representative Order Routing System (MORRE) highlighted our innovation, as do these other examples of products launched on MX:

- April 1988, three-month Canadian bankers' acceptance futures contracts, (BAXTM)

- September 1989, 10-year Government of Canada bond futures contracts, (CGBTM)

- January 1995, five-year Government of Canada bonds futures contracts, (CGFTM).

In 1999, we led a restructuring of the Canadian capital markets that made us the first traditional exchange in North America to specialize in derivatives. We demutualized and further enhanced our automation, setting the stage for even more innovation. For example:

- September 7, 1999, we traded futures contracts (SXFTM) on the S&P/TSX 60 Index

- April 2004, we launched two-year Government of Canada bond futures (CGZTM)

- October 2005, we completed the first implementation phase of a proprietary “next generation” trading system called SOLA®.

- November 2007, we began trading 30-year Government of Canada bond futures (LGBTM).

In early 2008 we combined with TSX to create TMX Group. As Luc Bertrand said about this exciting step, “The new group will redefine the Canadian capital markets and strengthen its global positioning.” This opened the door to an accelerated rate and scope of innovation.

Launching three-month CORRA Futures contract (CRATM) and re-listing 2-year Government of Canada bond futures (CGZTM) in 2020, and then one-month CORRA Futures contract (COATM) in 2023, and options on the three-month CORRA Futures (OCRTM) in January 2024 are other chapters in our long story of exchange leadership and market innovation.

Committed to Our Communities

Our founders were local community leaders. Their spirit of commitment has remained essential to how we operate within the local, national and international communities in which we live, work and volunteer.

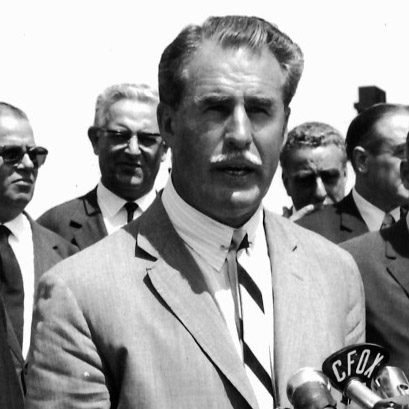

George Hees, our president in 1964-65, is a great example of that commitment.

A talented young athlete who won the Grey Cup® with the Toronto Argonauts® in 1938, George was a decorated officer during the Second World War. He successfully ran for public office in 1950 and sat as an MP for more than 35 years. He served in the cabinets of Prime Minister John Diefenbaker and, years later, Prime Minister Brian Mulroney. George died in 1996, at the age of 85.

In 1965, George oversaw our monumental move to Place Victoria and the installation of our new, world-leading electronic quotation and transmission system before returning to federal politics at the end of that year.

There are countless examples of commitment to our communities. For instance, under the leadership of Robert Demers, our President from 1976 to 1981, the Montreal Stock Exchange was a founding supporter of Les Mercuriades. These awards, started in 1981 by the Quebec Chamber of Commerce, honour success among Quebec’s businesses.

Market Leaders Through the Years

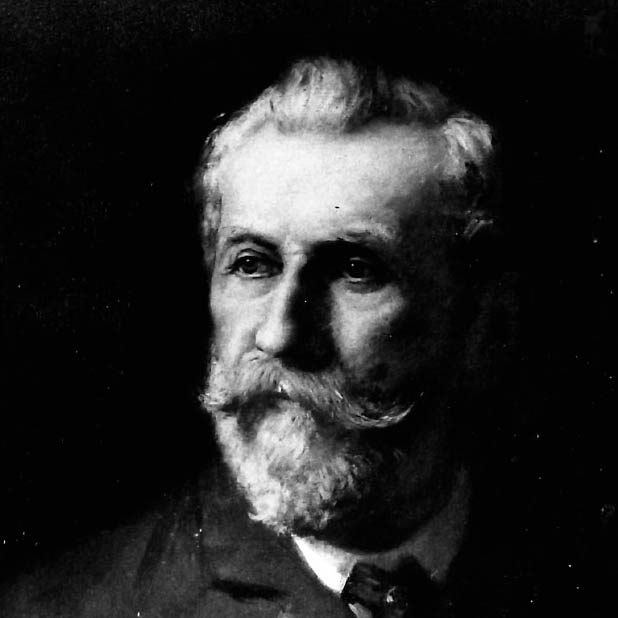

We have had 45 different presidents since 1874, three of whom held the office for two separate terms. Henry Norman was the Exchange’s first full-time president, as of 1956. There have been 13 Francophone presidents since 1874, starting with Louis-Joseph Forget in 1895. The first full-time Francophone president was Michel Bélanger, who held the role from 1972-1976. Since January 1, 1972, all nine presidents have been Francophone.

Our leaders have worked with highly experienced colleagues in navigating wars, pandemics, business cycles and scandals over the last 150 years. We have helped to create significant wealth and countless jobs within the broader ecosystem of traders, issuers and regulators. We have also experienced challenges that come with operating marketplaces in which some degree of risk is always present.

In 2024, our team is more resilient and diverse than ever. Together we are building even stronger foundations for the next 150 years.

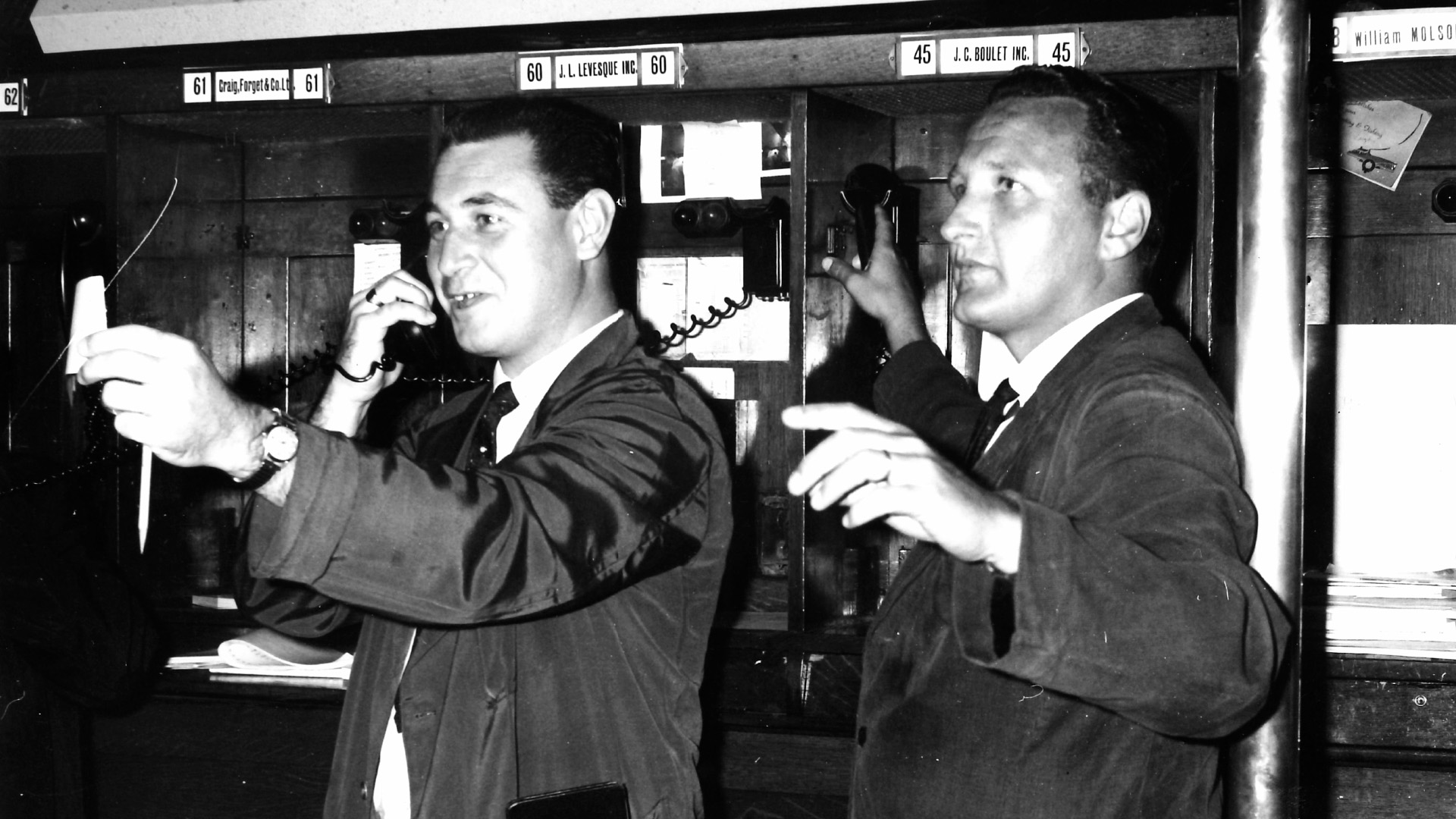

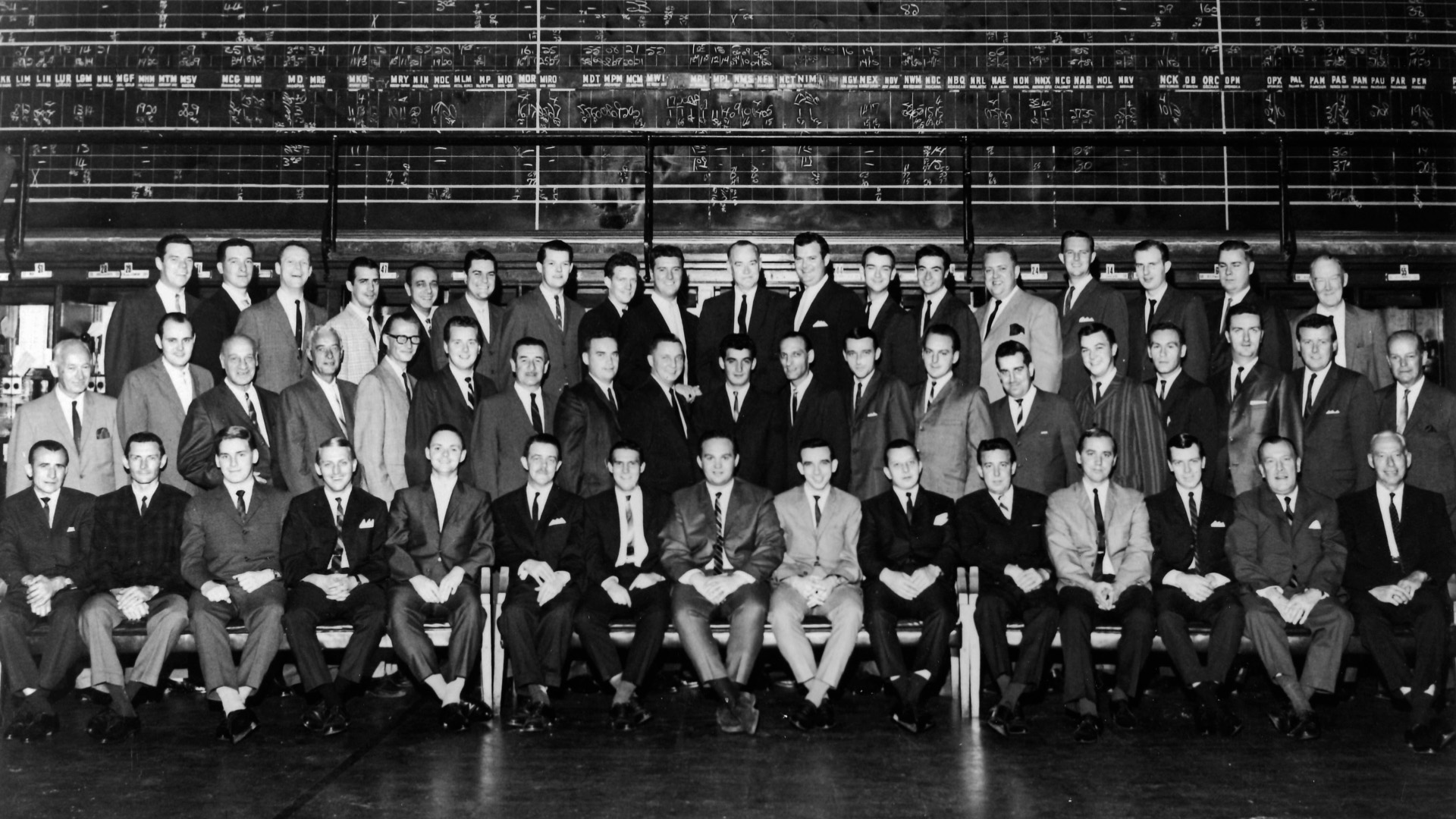

Photo Gallery

Copyright © 2024 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. The information provided is not an invitation to purchase securities listed on Montreal Exchange, Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Montréal Exchange, MX and SOLA are the trademarks of Bourse de Montréal Inc. All third-party product, company names, logos, trademarks™ or registered® trademarks remain the property of their respective holders. Use of them does not imply any affiliation with or endorsement by them.