Module 3: Call Options Explained

Call options are a fundamental part of options trading. Let's break down what they are and how they work:

What is a Call Option?

- Definition: A call option gives you the right to buy a stock at a specific price within a set time period.

- It's like a coupon that lets you buy a product at a certain price, even if the store price goes up.

Rights and Obligations

- Call Buyer: Has the right to buy the stock at the strike price.

- Call Seller: Has the obligation to sell the stock if the buyer uses their option.

When to Buy a Call Option

- You buy a call when you think the stock price will go up.

- It's a way to benefit from a rising stock price without spending as much money as buying the stock outright.

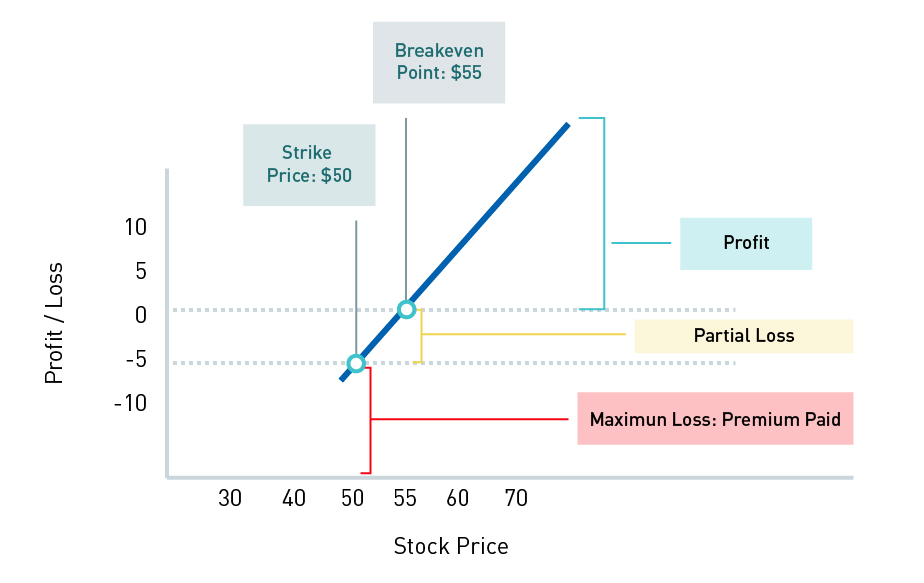

Potential Profits and Losses

- Maximum Loss: The premium you paid (if the stock price doesn't go above the strike price)

- Maximum Profit: Unlimited (the stock price could keep rising)

| Call Option Outcomes | |

| Profit | Stock price > Strike price + Premium |

| Partial loss | Strike price < Stock price < Strike price + Premium |

| Total loss of premium | Stock price < Strike price |

Here's an example:

Let's demonstrate the call options outcomes for a call option with a strike price of $50 and a premium of $5:

Break-even point: $55

Strike price: $50

Real-world Scenarios

- Expecting good news: If you think a company will report strong earnings, you might buy a call option instead of the stock.

- Cheaper alternative: If you want to benefit from a stock's rise but can't afford to buy 100 shares, a call option might be a more affordable choice.

Example:

Let's use "CanTech Innovations," a fictional company from the Information Technology industry sector. CanTech is currently trading at $100.

- You buy a call option with a strike price of $105, expiring in two months, for a premium of $3 per share.

- Total cost: $3 × 100 shares = $300

Possible outcomes:

1. If CanTech rises to $110:

- Your option is worth at least $5 per share ($110 - $105)

- Potential profit: $500 - $300 = $200

2. If CanTech stays at $100:

- Your option expires worthless

- You lose your $300 premium

Exercise

1. You buy a call option with a strike price of $50 for a premium of $2. The stock is currently at $48. What's the breakeven stock price?

- $50

- $52

- $48

2. What's the maximum you can lose when buying a call option?

- The premium paid

- The strike price

- It's unlimited

3. True or False: When you buy a call option, you're obligated to buy the stock.

Answers: 1) b, 2) a, 3) False

Call options can be a powerful tool in your investment toolkit. They offer a way to potentially benefit from rising stock prices with a smaller initial investment. However, remember that they also come with risks, including the possibility of losing your entire premium.

Now, let's explore the flip side: put options. These powerful tools can help protect your investments and profit in declining markets. Ready to expand your options knowledge? Let's move on to Module 4!

Disclaimer:

The strategies presented in this article are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Copyright © 2024 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.'s prior written consent. This information is provided for information purposes only. The views, opinions and advice provided in this article reflect those of the individual author. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial, or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Montreal Exchange, Toronto Stock Exchange, and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design are the trademarks of TSX Inc. and are used under license.