Three Mistakes to Avoid when Trading Options

Welcome to the world of options trading! Whether you're managing a small portfolio or aspiring to be the next big investor, everyone makes mistakes. But here's the good news: with the right knowledge, you can sidestep the most common pitfalls. Let's dive into three crucial mistakes to avoid as you begin your options trading journey.

Mistake #1: Neglecting to Craft your Options Trading Strategy

Why a Well-Planned Approach is your Roadmap to Success

One of the most common mistakes investors make is diving into options trading without a well-crafted strategy. While options offer the opportunity to profit in various market conditions, many beginners underestimate the importance of thorough preparation. This lack of a strategic approach can lead to unnecessary risks and potential losses.

Imagine you're planning a road trip across Canada. You wouldn't just hop in the car and start driving without a map or destination in mind, right? The same principle applies to options trading. Your strategy is your roadmap to financial success.

For example, let's say you're interested in the growing renewable energy sector. You've been watching GreenPower Energy (a fictional company listed on the TSX), and you believe their stock will rise in the next few months due to new government incentives. Instead of simply buying call options and hoping for the best, a well-thought-out strategy might involve:

- Researching the company's financials and the renewable energy market

- Setting a specific profit target and maximum loss you're comfortable with

- Choosing an appropriate expiration date that aligns with your market outlook

- Deciding on an exit strategy, whether the trade goes in your favor or against you

By following these steps, you're not just trading – you're investing with purpose.

Investors who understand the options market and the dynamics that impact prices can create a strategy ranging from simple to advanced to achieve their financial objectives. Some of the considerations and variables that must be understood before entering a trade include:

- Risk/reward profile (evaluation of upside potential versus possibility of a loss)

- Impact of time depreciation (options lose value as they approach the expiration date)

- Effect of volatility on option prices

- Liquidity (the ability to get in and out of the position effectively)

- Commission costs

- Strategy complexity

Investors who trade options should be agile

That said, each option strategy will perform differently depending on market conditions. As such, investors should be agile and continuously:

- Assess market conditions and determine objectives

- Research available option strategies

- Create a plan to manage the position

- Execute the trade

- Manage expectations accordingly

Let's expand on our GreenPower Energy example to illustrate this agility. Suppose you've done your research and decided to buy call options with a strike price of $30, expiring in three months. Your strategy might look like this:

- Current stock price: $25

- Your outlook: You expect the stock to reach $35 within two months due to anticipated government announcements on renewable energy subsidies.

- Risk management: You're willing to risk a maximum of $500 on this trade.

- Profit target: You aim to make a 100% return on your investment.

- Exit strategy: You plan to sell half of your options if they reach your profit target and let the rest ride with a trailing stop.

However, let's say after a month, the government announcement is delayed, and GreenPower Energy's stock price hasn't moved much. This is where your agility comes into play. You might reassess your strategy by:

- Reviewing your original thesis: Is it still valid, or have market conditions changed?

- Adjusting your timeline: Perhaps you need to consider options with a longer expiration date.

- Managing your risk: You might decide to cut your losses if the stock drops below a certain level.

- Exploring alternative strategies: Maybe a spread strategy would be more appropriate given the new circumstances.

For beginners, it's often wise to start with simpler strategies and gradually move to more complex ones as you gain experience. You might begin with straightforward calls or puts, then progress to spreads or other multi-leg strategies as your understanding grows.

By avoiding the mistake of trading without a strategy, you're setting yourself up for a more controlled and potentially more successful options trading experience. Your strategy is your compass in the sometimes turbulent sea of options trading – it helps you stay on course and make rational decisions, even when market emotions run high.

Mistake #2 - Equating Low-Cost Options with Good Value

Why Cheap isn't Always Cheerful in Options Trading

A common pitfall for novice options traders is the assumption that low-priced options always represent good value. This mindset, often stemming from the 'buy low, sell high' mantra of stock trading, can lead to poor decision-making in the options market. Understanding why 'cheap' doesn't necessarily mean 'valuable' is crucial for successful options trading.

We've all been tempted by a great bargain, but in options trading, 'cheap' doesn't always mean 'good value.' Think of it like buying a car. A $500 used car might seem like a steal, but if it breaks down after a week, was it really a bargain?

Let's use an example from the Canadian technology sector. Imagine NorthStar Tech (another fictional TSX-listed company) is trading at $50 per share. You see a call option with a strike price of $60 expiring in one week for just $0.10. It might be tempting to buy this 'cheap' option, thinking, 'If the stock goes up just a little, I'll make a fortune!'

However, for this option to be profitable, NorthStar Tech would need to jump 20% in just one week – a rare occurrence unless there's major news. The option is cheap because the market considers this scenario unlikely.

The fact is, options are priced based on the likelihood of the option being in-the-money on or before the expiration date. If a stock's price is far removed from the current price, this will be reflected in an option's low price. Similarly, if a stock's price is close to the strike price, the option will have some value to it.

Another factor that determines the price of an option is the date selection. An option that is close to the expiration date will have less value attached to it compared to a longer-dated option.

For example, suppose NorthStar Tech trades at $50 per share and an investor buys a $55 call option that expires in five days. This means that the stock has a very short period of time to move higher and the price will imply a lower likelihood of hitting the $55 target in such a quick period.

By contrast, a $55 call option that expires in five months gives more breathing room to the investor and time is on their side. Options that expire at further out dates will be more expensive because the likelihood of hitting the $55 target is much higher.

Instead of chasing the cheapest options, consider looking at options that are closer to the current stock price or have more time until expiration. They may cost more upfront but often provide better opportunities for profit.

Mistake #3: Overlooking the Impact of Implied Volatility

How Ignoring this Key Factor Can Derail Your Options Strategy

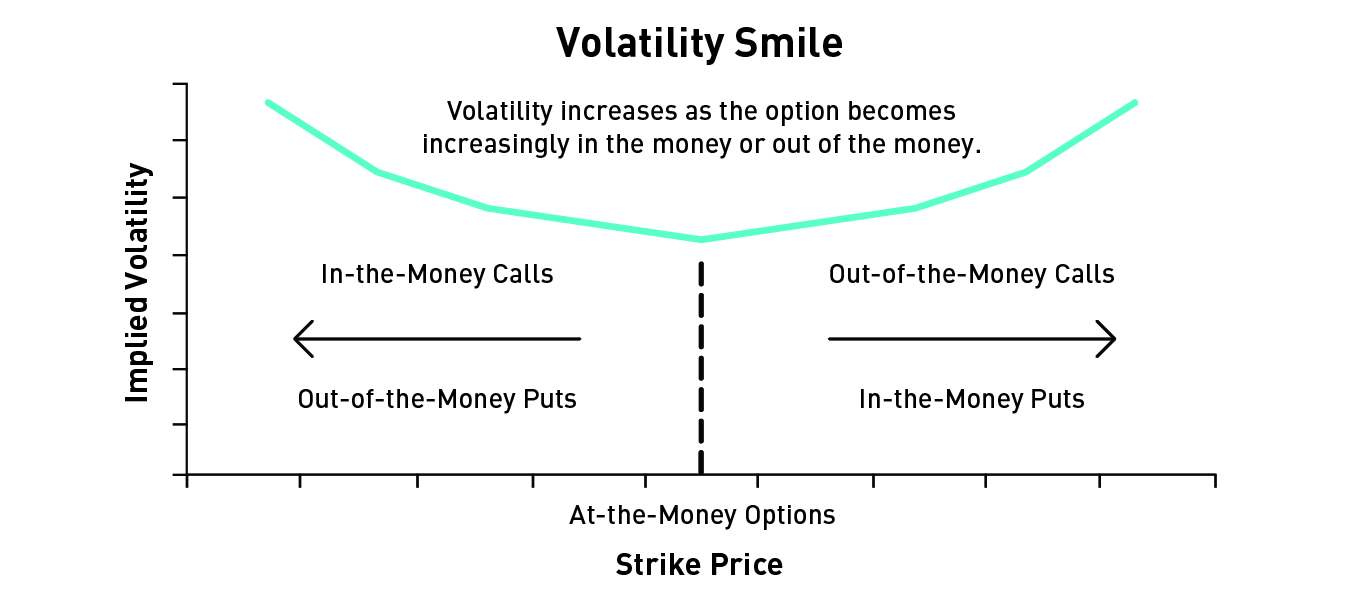

One of the most critical, yet often overlooked, aspects of options trading is implied volatility. Many novice traders make the mistake of focusing solely on the direction of the underlying asset, neglecting the significant impact that implied volatility has on option prices. This oversight can lead to unexpected outcomes and potential losses, even when your directional prediction is correct.

Think of implied volatility as the weather forecast of the options world. It tells us how stormy or calm the market expects a stock to be. High implied volatility is like a storm warning – it suggests the market expects big price swings, which makes options more expensive.

Let's use an example from the Canadian mining sector. GoldRush Minerals (our fictional mining company) is about to release its quarterly earnings report. The market is unsure whether the results will be good or bad, so implied volatility is high.

Here's how it might play out:

- Before earnings: A call option might be expensive due to high implied volatility.

- After earnings (good news): The stock price rises, but the option price might not increase as much as expected because implied volatility drops.

- After earnings (bad news): The stock price falls, and the option loses value both from the price drop and the decrease in implied volatility.

Factors that would contribute towards pricing Implied Volatility include upcoming earnings, company-specific events, and the broader economic environment.

What this means is that as risk and uncertainty increases in a stock, the option price may likely rise in value to compensate for this risk. That said, a jump in the stock's price coupled with a decrease in volatility can result in a lower option price.

Consider this example that references the purchase of a call option during a period of high implied volatility:

Imagine you buy a call option on GoldRush Minerals with a strike price of $70 when the stock is trading at $62. The option costs $2.05, and implied volatility is high at 70% due to upcoming earnings. After earnings are released, the stock jumps to $66, but implied volatility drops to 40%. Despite the stock price increase, your option might only be worth $1.46 due to the volatility crush.

What this means is that simply buying a call option and assuming it will gain in value if the stock moves up is an incorrect conclusion. Understanding how Implied Volatility factors into an option's pricing will play a large role in an investor's decision-making process.

Purchasing a call option during a period of high implied volatility

| Today | 3 Days Later | ||

| Stock price | $62.00 | Stock price | $66.00 |

| Strike price | $70.00 | Implied volatility | 40% |

| Time | 30 days | Change due to Delta | $1.21 |

| Call option price | $2.05 | Change due to Vega | ($1.80) |

| Implied volatility | 70% | Net change | ($0.59) |

| Delta | 0.304 | Call option price | $1.46 |

| Vega | 0.06 | ||

Understanding implied volatility helps you avoid overpaying for options and better predict how option prices might change after major events.

Conclusion

Options trading can be an exciting and potentially profitable venture, but it requires knowledge, strategy, and discipline. By avoiding these three common mistakes – lacking a strategy, blindly chasing 'cheap' options, and ignoring implied volatility – you're already ahead of many novice traders.

Remember, successful options trading is a journey, not a sprint. Keep learning, stay informed about market trends, and always trade within your risk tolerance. With time and practice, you'll develop the skills to navigate the options market with confidence.

Savvy and disciplined investors learn from their mistakes and constantly study the market. They are more likely to progress towards their financial goals. This applies to investors across all asset classes, especially options.

Keep exploring, keep learning, and most importantly, trade smart!

Disclaimer:

The strategies presented in this article are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Copyright © 2024 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.'s prior written consent. This information is provided for information purposes only. The views, opinions and advice provided in this article reflect those of the individual author. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial, or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Montreal Exchange, Toronto Stock Exchange, and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design are the trademarks of TSX Inc. and are used under license.