The Exchange's markets are closed today, December 26, 2025.

September 14, 2022Advisory Notice A22-009

Update on Canadian benchmark transition and roadmap for BAX and CORRA Futures

Montreal Exchange (the "Bourse") wishes to inform market participants that, as part of the broader migration from CDOR to CORRA, the Bourse is working to ensure a seamless transition for participants across its listed market offering. As part of these efforts and in collaboration with CARR, the Bourse is planning to undertake market structure changes to maintain and enhance liquidity in key short-term interest rate products. In this context, the Bourse would like to provide the following updates regarding the Canadian benchmark transition and its upcoming roadmap for BAX and CORRA Futures.

Fostering the adoption of CORRA Futures:

As highlighted in its previous communications, the Bourse has recently launched, in partnership with TD Securities and National Bank Financial, a new market making program on the 3M CORRA Futures (CRA) contract. This program aims to develop and grow the product as the transition efforts continue to gradually materialize. As outlined by CARR in their roadmap document, key dates and milestones are coming up in 2023 and should benefit the adoption of CORRA Futures:

- CORRA-first initiatives for interbank derivatives trading on January 9 and March 27, 2023

- "No new CDOR derivatives or securities" with limited exception after June 30, 2023

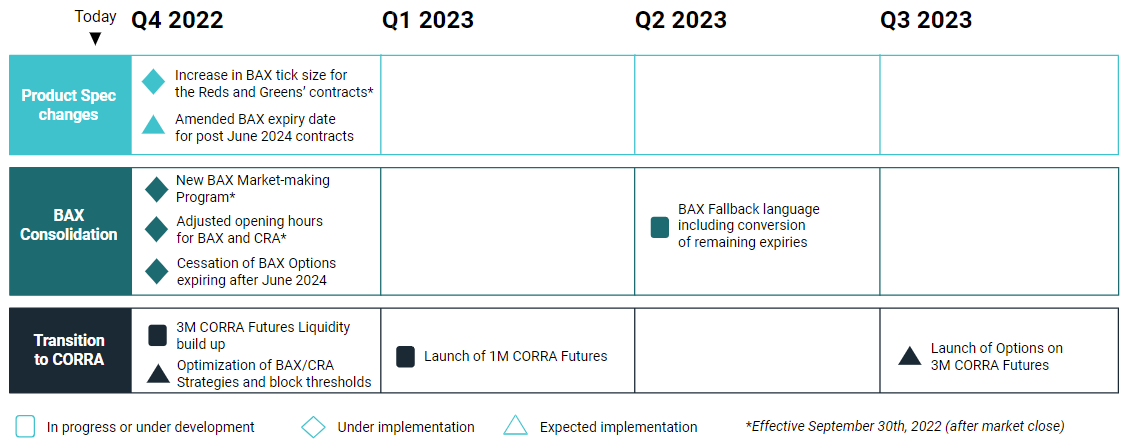

In concert with CARR's objective to guide market participants in their transition, the Bourse plans to list a 1M CORRA Futures (COA) contract in Q1 2023, subject to obtaining the required regulatory approvals. The product will respond to industry demand and build on Canada's transition efforts across the CORRA ecosystem by supporting the determination of a Term CORRA rate, similar to the development of other forward-looking term structures across jurisdictions (e.g.: term SOFR and SONIA rates). The Bourse supports CARR's transition roadmap and is committed to work with the industry to ensure a timely and orderly adoption of CORRA-based products.

Transition management plan (from BAX to CORRA futures):

In an effort to maintain a healthy BAX market, consolidate liquidity and ensure a smooth transition to CORRA Futures until CDOR's cessation date, the Bourse plans to implement a series of measures in the coming months:

Modification of opening hour for BAX and CRA

Effective Friday, September 30th 2022 (after market close), the Bourse will modify the opening time of the 3M BA Futures (BAX) and 3M CORRA Futures (CRA) contracts, from 8:00 pm ET to 2:00 AM ET. The Bourse plans to eventually restore the opening time of the CRA contract to 8:00 pm ET once sustained activity has developed in the contract.

New BAX market-making program

Effective Friday, September 30th 2022 (after market close), the Bourse will implement a new market-making program for BAX during its trading hours, to help sustain healthy liquidity conditions while participants are transitioning their exposure into 3M CORRA Futures.

Increase of minimum price fluctuation for BAX Reds and Greens

Effective Friday, September 30th 2022 (after market close), the Bourse will increase the tick size of the BAX 2nd and 3rd year of contract expiry (BAX Reds and Greens), as announced in previous communication.

Adjustment of BAX expiry date for post June 2024 expiries

The Bourse will implement in the upcoming months an amendment to the expiry date for post June 2024 contracts from the 3rd Monday to 3rd Wednesday of the contract month, thereby aligning the exposure period with that of equivalent 3M CORRA Futures.

Formalization of BAX fallback provision

In 2023, the Bourse expects to modify its Rules to clarify the BAX fallback provision following CDOR's cessation, which should enable the conversion of outstanding BAX open interest (post June 2024 expiries) into equivalent CRA contracts, using ISDA's official Spread Adjustment for the 3M CDOR tenor.

Listing of Options on BAX & CORRA

The Bourse will not list Options on BAX that have an expiry date beyond June 2024; all Options on BAX (regular and mid-curves) currently or eventually listed (and expiring before the end of June 2024) will expire following the current process. In addition, the Bourse is expecting to launch Options on 3M CORRA Futures in the second half of 2023.

Review of block threshold

Given the recent market dynamics and liquidity conditions, the Bourse is reevaluating the minimum volume thresholds applicable to block transactions on BAX and BAX/CRA strategies, consistent with the view of facilitating a seamless transition to CORRA futures. More details on this initiative will be provided in due time.

The Bourse will continue to work in collaboration with the industry and CARR to ensure a smooth transition. Additionally, the Bourse plans to provide more details and update on the above measures in due time and reserves the right to make necessary adjustments based on further market assessment and consultations with market participants.

MX Benchmark Transition - Projected Roadmap

For additional information on this notice, please contact:

Robert Tasca

Managing Director, Derivatives Products & Services

Phone:1-(514)-871-3501

Email: robert.tasca@tmx.com

The information contained in this document is for information purposes only and shall not be construed as legally binding. This document is a summary of the product's specifications which are set forth in the Rules of Bourse de Montreal Inc. ("Rules of the Bourse"). While Bourse de Montreal Inc. endeavors to keep this document up to date, it does not guarantee that it is complete or accurate. In the event of discrepancies between the information contained in this document and the Rules of the Bourse, the latter shall prevail. The Rules of the Bourse must be consulted in all cases concerning product's specifications.

© 1996-2022 Bourse de Montréal Inc. 1800 - 1190 Avenue des Canadiens-de-Montréal P.O. Box 37 Montréal (Québec) H3B 0G7, Canada

[1] Canadian Alternative Reference Rate (CARR) working group

[2] Advisory Notice A22-004: Update on 3M CORRA Futures and BAX following CDOR cessation

[3] https://www.bankofcanada.ca/wp-content/uploads/2022/05/transition-roadmap.pdf

[4] RBSL issues CDOR cessation notice

[5] Circular 101-22 - Market making of the extended trading hours period

[6] Circular 115-22 - Self-certification - Amendments to Rules of the Bourse de Montreal Inc regarding the BAX minimum price fluctuation

[7] Technical Note from Bloomberg following CDOR cessation announcement